Every time you walk into a doctor’s office, you’re not just signing up for treatment-you might also be signing away your financial rights. Until recently, most patients didn’t even realize that the consent form they signed at check-in bundled together permission for medical care and permission to charge them. That’s changing. Starting October 20, 2024, New York State implemented three new laws designed to stop predatory billing practices and give patients real control over their money and medical decisions. These aren’t vague guidelines-they’re enforceable rules with real penalties for providers who break them.

Separate Consent for Treatment and Payment

For decades, clinics and hospitals used one form to get patients to agree to both treatment and payment. You’d sign your name at the front desk, and that signature became permission to bill you for everything from a flu shot to an MRI. But under New York Public Health Law Section 18-c, that’s no longer allowed. Providers must now get separate, clear consent for medical treatment and for payment. This means if you’re getting an X-ray, your consent to receive care can’t be hidden inside a document about paying with CareCredit® or a credit card.

Violating this rule costs providers $2,000 per incident. That’s not a warning-it’s a fine. And it’s not just about paperwork. It’s about power. When consent is bundled, patients often don’t realize they’re agreeing to financing terms they might not understand. Now, they have to actively choose how they’ll pay, not just be handed a form that assumes they already have.

There’s a twist, though. As of August 7, 2025, enforcement of Section 18-c was suspended by state officials. That means, for now, providers aren’t being penalized for using combined forms. But the law hasn’t been repealed. It’s on pause, not gone. Patients and providers alike are left in uncertainty-waiting to see if it will return, change, or disappear entirely.

No More Filling Out Your Financing Applications

Have you ever been asked if you’d like to apply for CareCredit® while sitting in the waiting room? Maybe the receptionist handed you a tablet and said, “I’ll help you get started.” That’s now illegal under General Business Law Section 349-g.

Providers can’t complete any part of a medical financing application-not even helping you check boxes or choose payment plans. They can answer questions. They can explain what CareCredit® is. But the patient must fill out every field themselves. No pre-filling. No nudging. No pressure.

Why? Because these applications are financial products. And when staff help patients apply, it creates an uneven power dynamic. A patient in pain, worried about cost, might say yes just to get the appointment over with. The law shuts that door. Violations? Up to $5,000 per offense. That’s serious money for a small clinic.

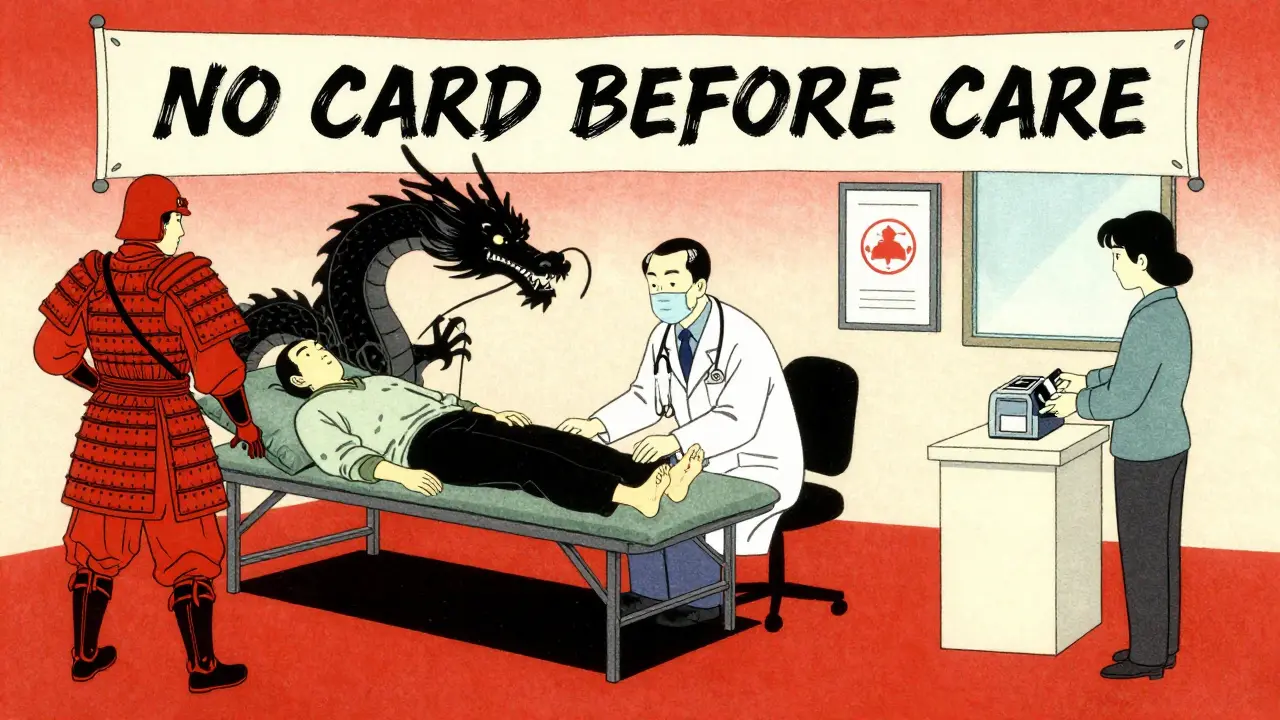

Credit Cards Before Emergency Care? Not Allowed

Imagine you’re rushed to the ER after a fall. You’re in pain. You’re scared. Then the front desk asks for your credit card number-before they even treat you. That’s exactly what General Business Law Section 519-a now bans.

Providers can’t require you to give credit card information before they deliver emergency or medically necessary care. They also can’t keep your card on file unless you specifically ask for it. And even then, they must warn you: using a regular credit card for medical bills means you lose key protections.

Here’s the crucial part: only debt from healthcare-specific financing products like CareCredit®, LendingClub Medical Loans, or similar programs qualify for state and federal medical debt protections. That includes no credit reporting, no wage garnishment, and no liens on your home. But if you pay with a Visa or Mastercard, you’re treated like any other consumer debt. And that’s dangerous. According to the Consumer Financial Protection Bureau, 74.6 million Americans had medical debt in 2022. Many of them used regular credit cards-and now they’re stuck with no safety net.

Every time you use a credit card to pay a medical bill in New York, the provider must give you a written warning explaining this risk. No exceptions.

Federal vs. State: What’s the Difference?

People often think federal laws cover everything. But New York’s new rules go further than the No Surprises Act, which took effect in January 2022. That law stops surprise bills from out-of-network providers. It doesn’t touch how you pay, what forms you sign, or whether your credit card is on file.

New York’s laws target in-network providers-the ones you chose, the ones you trust. They’re going after the quiet, everyday practices that add up: bundled consent, staff-assisted financing, and credit card collection before treatment. These aren’t flashy emergencies. They’re slow leaks in the system that turn medical bills into long-term financial disasters.

And while the federal government removed medical debt from credit reports in 2024, New York’s laws prevent patients from slipping into that debt in the first place. It’s prevention, not cleanup.

Why This Matters for Real People

Let’s say you’re a single parent with a child who needs physical therapy. You’ve got a high-deductible plan. You’re $1,200 out-of-pocket. The clinic offers you CareCredit®-0% interest for 12 months. You’re tired. You sign. They help you fill out the form. You don’t read the fine print. A year later, you miss a payment. Now you’re charged 24% interest. Your credit score drops. You get collection calls.

Under the old system, that’s normal. Under New York’s new rules, that scenario is illegal. The clinic can’t help you apply. They can’t collect your card before treatment. They can’t hide payment terms inside a consent form. You have to make those choices, fully informed, on your own.

It’s not about making healthcare harder. It’s about making it fair. When patients are rushed, scared, or in pain, they shouldn’t be pressured into financial traps disguised as convenience.

What Providers Must Do Now

For clinics, hospitals, and private practices, this isn’t just policy-it’s a full system overhaul. Staff need retraining. Forms need redesigning. Payment systems need updates. Goldsand Friedberg’s legal advisory recommends keeping detailed records of every change made to prove compliance. That means documenting staff training sessions, updated consent forms, and patient warnings given at the point of payment.

It’s expensive. It’s time-consuming. But the cost of non-compliance is worse: $2,000 to $5,000 per violation. That’s not a fine-it’s a lawsuit waiting to happen.

And the pressure isn’t stopping. The Consumer Financial Protection Bureau has already removed medical debt from credit reports. The No Surprises Act is in place. New York’s laws are the next step. Experts predict other states will follow. California, Illinois, and Massachusetts are already reviewing similar proposals. This isn’t a New York quirk. It’s the future of patient protection.

What You Should Do as a Patient

If you’re in New York, here’s what to watch for:

- Ask if consent for treatment and payment are on separate forms.

- If someone tries to help you fill out a CareCredit® or similar application, say no. You have the right to do it yourself.

- If you’re asked for a credit card before treatment, refuse. You can pay after care, and you’re entitled to a warning about the risks of using a regular card.

- Keep copies of all financial disclosures you’re given. If something goes wrong, you’ll need proof.

These laws exist because too many people got buried under medical debt they didn’t understand. They weren’t cheated by rogue providers. They were failed by a system that assumed they’d just sign anything.

Now, you have more power. Use it.

Do these laws apply to all healthcare providers in New York?

Yes, the three new laws apply to all providers licensed in New York State, including hospitals, clinics, private practices, and outpatient centers. The rules cover anyone who bills patients directly for medical services, regardless of size or specialty. Even small dental offices and physical therapy studios must comply.

What’s the difference between CareCredit® and a regular credit card for medical bills?

CareCredit® and similar healthcare-specific financing products are designed for medical expenses and come with special protections under New York and federal law. These include no credit reporting of late payments, no wage garnishment, and no liens on your home. Regular credit cards don’t have these protections. If you use a Visa or Mastercard for medical care, your debt is treated like any other consumer debt-making it easier for collectors to sue you or damage your credit score.

Can I still use my credit card to pay for medical care?

Yes, you can still use your credit card. But providers must now give you a clear written warning before you pay, explaining that using a regular credit card means you lose important medical debt protections. You must also be allowed to pay after treatment-no one can require your card before giving you emergency or necessary care.

Why was Section 18-c suspended?

Section 18-c, which required separate consent for treatment and payment, was suspended in August 2025 due to confusion among providers about implementation. The New York State Department of Health is reviewing feedback and may revise the rule or reinstate it with clearer guidelines. Until then, enforcement is paused, but the law still exists and could return.

Do these laws protect people without insurance?

Yes. These laws protect all patients, regardless of insurance status. Uninsured patients are often the most vulnerable to predatory billing practices. The rules ensure they’re not pressured into financing they don’t understand and can’t afford. They also guarantee that providers can’t demand payment before delivering emergency care-whether you have insurance or not.